As a CEO in digital and mobile world, security is a great concern for everyone involved, most notably the customer. As a Northwestern student studying Integrated Marketing and a user of mobile payment services, I have found several measures to properly align and prepare oneself in the industry with the most important thing being extremely secure.

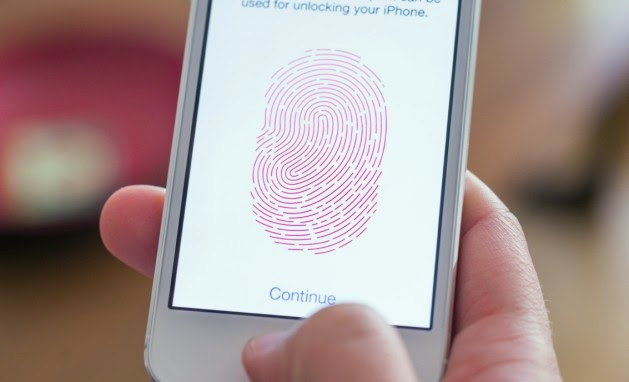

Even your fingerprint isn’t secure enough. Recently the Samsung Galaxy S 5 smart phone introduced a fingerprint scanning technology to access the phone. However there have been some issues that Zach Epstein described in detail. PayPal a mobile payment company doesn’t require a password if the app has already been configured for fingerprint authentication. Just a few weeks old, it has already been hacked. Improved security is a must, but perhaps Samsung rushed into this. It is not clear if this is a minor glitch that can be fixed or if it is a significant problem but what is clear is that we must continue to improve and strengthen the security of personal information.

If some people have their way soon you will not need to go to a psychic to read you palm. As the Wall Street Journal reports some Swedish students have devised another way to expediting and enhancing the mobile payment experience for an individual. Sven Grundberg notes that this new technology is slightly behind fingerprint scanning in terms of development and testing. Although this technology is further behind it is supposed to be just as quick, only taking 5 seconds or so to register, but it has the benefit of greater security than fingerprints.

Based on the insights I received from these two articles there are three action items you should immediately take to be well positioned in the mobile payment world. The three things that mobile payment companies should do include:

1. Start to move away from old-fashioned passwords – Old fashion passwords with combinations of letters and numbers are ineffective nowadays and can be easily hacked. This is the first step in increasing security is creating more complex passwords.

2. Highly emphasis security and build trust, let a person hold all power - Let’s face it, the person people trust the most is themselves. By allowing the individual customer to control all of the power in terms of securing their information, you are giving the customer exactly what they want. Not only does this increase the security but it builds greater trust with a company. This is the second step in being competitive in the mobile payments world.

3. People want quick accessibility, must be able to keep up with demand – People are always on the go and those companies that can keep up with people are ones who succeed. The average person wants to have immediate access and convenience at the touch of the fingertips. Mobile payments are supposed to be quicker and easier. Typing long and complicated passwords is not what people want. Those who are able to provide instant access will be able to survive and thrive in the ever-changing digital world.

Through research it has been discovered that the most important aspect of mobile payment services that people are concerned with is security. In order for there to be a revolution and mass migration towards the mobile payment industry, people must feel that their information is incredibly secure. Hopefully fingerprints scanners and palm readers can lead the industry to greatness.

Daniel Cohen is a graduating Northwestern student with a focus in Integrated Marketing that will be pursuing a Master’s degree in Management at the Kellogg School of Management next year. If you would like to discuss these issues further please contact him on twitter at @DanCohen102. Thanks.

No comments:

Post a Comment